On 13 May, Royal Decree-Law 18/2020, of 12 May, on social measures to protect employment (“RDL 18/2020”) entered into force. Below is a summary of the main measures implemented by RDL 18/2020:

1. Specific measures in the field of temporary layoffs (expediente de regulación temporal de empleo or “ERTEs”) due to force majeure:

- The duration of ERTEs due to force majeure is no longer linked to the state of alarm. Those companies which applied an ERTE due to force majeure can continue under its regime provided that the causes preventing the resumption of the business activity remain, and in any event until 30 June 2020.

- The ERTE due to force majeure may be partial, when the underlying causes allow the partial resumption of the business activity and in any event until 30 June 2020. As a result, adjustments regarding reduction in working hours will prevail.

- In this case, companies have 15 days to notify the labour authorities of the partial withdrawal of the ERTE due to force majeure. Prior to this notice, companies shall notify the State Public Employment Service of any changes the data contained in the initial collective application for access to unemployment benefit.

2. ERTEs based on economic, technical, organizational and productive causes (“ETOP”): Article 23 of Royal Decree Law 8/2020, of 17 March (“RDL 8/2020”) will be applicable to ERTEs based on ETOP causes initiated after the enactment of RDL 18/2020 and until 30 June 2020, with the following specifications:

- It could be applied while an ERTE due to force majeure is in force.

- When the ERTE based on ETOP causes is initiated after the termination of an ERTE due to force majeure, the effective date of the former will be set back to the date of termination of the latter.

3. Extraordinary unemployment measures: These measures will be extended until 30 June 2020. However, the unemployment measures related to employees who have a permanent seasonal work contract (trabajadores fijos discontinuos) and those employees who carry out permanent and regular works which are repeated on certain dates will be extended until 31 December 2020 (article 25.6 of RDL 8/2020).

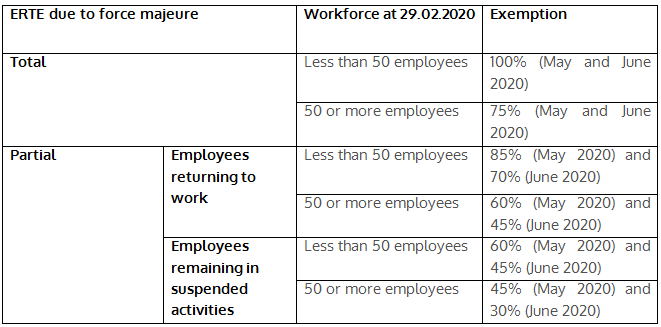

4. In the framework of ERTEs due to force majeure, exemption of company contributions and contributions for joint collections in the months of May and June 2020, will be as follows:

5. Limits related to dividend distribution and fiscal transparency:

- Companies with registered office for tax purposes in tax havens will not be able to benefit from an ERTE due to force majeure.

- Except for companies with less than 50 employees at 29 February 2020, companies affected by an ERTE due to force majeure using public resources allocated to such ERTEs would not be able to distribute dividends corresponding to the tax year where the ERTE was implemented, unless they reimburse the amounts corresponding to the exemptions on Social Security contribution payments.

Furthermore, that tax year will not be assessed for the purpose of exercising the shareholders withdrawal right (Article 348 bis. 1. of the Spanish Companies Act).

6. Extension of measures: The Government may:

- Extend the ERTEs due to force majeure, in view of the restrictions on activity due to health reasons that continue after 30 June 2020.

- Extend the exemptions in relation to the payment of the company contribution and the contributions for joint collections, as well as extend them to the ERTEs based on ETOP causes.

- Extend the unemployment protection measures provided for in Article 25.1 of RDL 8/2020.

In this regard, a Monitoring Commission will be set up. It will be composed of the Ministry of Employment, the Ministry of Inclusion, Social Security and Migration, the Spanish Confederation of Business Organisations (CEOE), the Spanish Confederation of the Small- and Medium-Sized Companies (CEPYME) and the trade unions CC.OO. and UGT.

7. Obligation to maintain employment: The Sixth Additional Provision of RDL 8/2020 has been slightly amended. In this regard, companies’ commitment to protect employment for a period of six months from the moment business resumes will be regulated as follows

- The period will start from the effective return to work of the employees affected by the ERTE due to force majeure, even if it is partial.

- The commitment shall be deem to have been breached if the dismissal or the termination of the contracts of any employee affected by the ERTE due to force majeure occurs. The exceptions are the following:

-

- When the employment contract is terminated due to disciplinary dismissal considered as fair by an employment court, voluntary resignation, death, retirement or total permanent disability, absolute or great disability of the employee, or due to the end of the appeal of the employees with permanent seasonal work contract (contrato fijo-discontinuo), when this does not imply a dismissal but an interruption.

- In temporary contracts, it will not be considered to have been breached when the contract is terminated due to the expiry of the term of the contract or the performance of the work or service or when the activity, which is the subject of the contract, cannot be performed immediately.

- Companies that do not comply with this commitment shall be required to reimburse the total amount of the contributions from which they were exempt, together with the corresponding surcharge and default interest, following proceedings by the Labour and Social Security Inspectorate to establish the breach and determine the amounts to be reimburse.

- In any case, the commitment to protect employment will be assessed in the light of the specific characteristics of the different industries/sectors and the applicable labour legislation, taking into consideration, specifically, the particularities of those companies that have a high variability or seasonality of employment.

- This commitment will not be applicable to those companies in which there is a risk of insolvency proceedings under the terms of Article 5.2 of the Insolvency Act.